Estimating Option-Implied Distributions for Asset Pricing

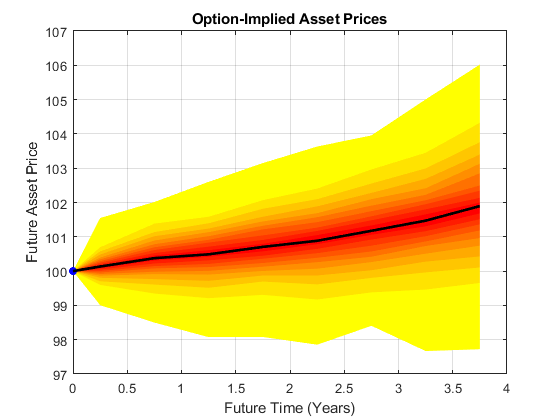

Estimating Option-Implied Probability Distributions for Asset Pricing

Forecasting the performance of an asset and quantifying the uncertainty associated with such a forecast is a difficult task: one that is frequently made more difficult by a shortage of observed market data.

Recently, there has been interest from central banks in using observed option price data for creating forecasts, particularly during periods of financial uncertainty. Call and put options on an asset are influenced by how the market believes that asset will perform in the future.

This code, along with the corresponding technical article, describes a workflow in which MATLAB® is used to create a forecast for the performance of an asset, starting with relatively scarce option price data observed from the market.

The main steps in this workflow are:

- Computing implied volatility from market data

- Creating additional data points using SABR interpolation

- Estimating implied probability densities

- Simulating future asset prices

- Presenting the forecast uncertainty in a fan chart

Installation and Getting Started

The examples are provided in a MATLAB project.

- Double-click on the project archive (

Options.mlproj) to extract it using MATLAB. - With MATLAB open, navigate to the newly-created project folder and double-click on the project file (

Options.prj) to open the project. - The main example file is the live script

DistributionsForAssetPricing.mlxwithin the project. - The examples rely on simulated option price data created by the function

generateSampleOptionData.mlx.

MathWorks® Product Requirements

This example was updated using MATLAB release R2022b.

- MATLAB®

- Statistics and Machine Learning Toolbox™

- Optimization Toolbox™

- Financial Toolbox™

- Financial Instruments Toolbox™

- Curve Fitting Toolbox™

License

The license for this entry is available in the license.txt file in this GitHub repository.

Copyright 2015-2023 The MathWorks, Inc.

Community Support

Citar como

Ken Deeley (2024). Estimating Option-Implied Distributions for Asset Pricing (https://github.com/mathworks/estimating-option-implied-probability-distributions-for-asset-pricing/releases/tag/v1.0.4), GitHub. Recuperado .

Compatibilidad con la versión de MATLAB

Compatibilidad con las plataformas

Windows macOS LinuxCategorías

- Computational Finance > Financial Instruments Toolbox > Price Instruments Using Functions > Equity Derivatives >

Etiquetas

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Descubra Live Editor

Cree scripts con código, salida y texto formateado en un documento ejecutable.

| Versión | Publicado | Notas de la versión | |

|---|---|---|---|

| 1.0.4.0 | See release notes for this release on GitHub: https://github.com/mathworks/estimating-option-implied-probability-distributions-for-asset-pricing/releases/tag/v1.0.4 |

||

| 1.0.3.0 | See release notes for this release on GitHub: https://github.com/mathworks/estimating-option-implied-probability-distributions-for-asset-pricing/releases/tag/v1.0.3 |

||

| 1.0.2.0 | See release notes for this release on GitHub: https://github.com/mathworks/estimating-option-implied-probability-distributions-for-asset-pricing/releases/tag/v1.0.2 |

||

| 1.0.0.1 | Updated license |

||

| 1.0.0 | See release notes for this release on GitHub: https://github.com/mathworks/estimating-option-implied-probability-distributions-for-asset-pricing/releases/tag/v1.0.0 |