cfport

Portfolio form of cash flow amounts

Syntax

Description

[

computes a vector of all cash flow dates of a bond portfolio, and a matrix mapping

the cash flows of each bond to those dates. Use the matrix for pricing the bonds

against a curve of discount factors.CFBondDate,AllDates,AllTF,IndByBond] = cfport(CFlowAmounts,CFlowDates)

Examples

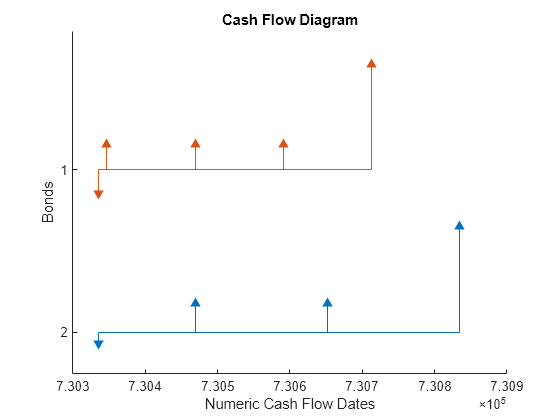

Use the function cfamounts to calculate the cash flow amounts, cash flow dates, and time factors for each of two bonds. Then use the function cfplot to plot the cash flow diagram.

Settle = '03-Aug-1999'; Maturity = ['15-Aug-2000';'15-Dec-2000']; CouponRate= [0.06; 0.05]; Period = [3;2]; Basis = [1;0]; [CFlowAmounts, CFlowDates, TFactors] = cfamounts(CouponRate,... Settle, Maturity, Period, Basis); cfplot(CFlowDates,CFlowAmounts) xlabel('Numeric Cash Flow Dates') ylabel('Bonds') title('Cash Flow Diagram')

Call the function cfport to map the cash flow amounts to the cash flow dates. Each row in the resultant CFBondDate matrix represents a bond. Each column represents a date on which one or more of the bonds has a cash flow. A 0 means the bond did not have a cash flow on that date. The dates associated with the columns are listed in AllDates. For example, the first bond had a cash flow of 2.000 on 730347. The second bond had no cash flow on this date For each bond, IndByBond indicates the columns of CFBondDate, or dates in AllDates, for which a bond has a cash flow.

[CFBondDate, AllDates, AllTF, IndByBond] = ...

cfport(CFlowAmounts, CFlowDates, TFactors)CFBondDate = 2×7

-1.8000 2.0000 2.0000 2.0000 0 102.0000 0

-0.6694 0 2.5000 0 2.5000 0 102.5000

AllDates = 7×1

730335

730347

730469

730591

730652

730713

730835

AllTF = 7×1

0

0.0663

0.7322

1.3989

1.7322

2.0663

2.7322

IndByBond = 2×5

1 2 3 4 6

1 3 5 7 NaN

Use the function cfamounts to calculate the cash flow amounts, cash flow dates, and time factors for each of two bonds.

Settle = datetime(1999,8,3);

Maturity = [datetime(2000,8,15) ; datetime(2000,12,15)];

CouponRate= [0.06; 0.05];

Period = [3;2];

Basis = [1;0];

[CFlowAmounts, CFlowDates, TFactors] = cfamounts(CouponRate,...

Settle, Maturity, Period, Basis);Call the function cfport to map the cash flow amounts to the cash flow dates. Each row in the resultant CFBondDate matrix represents a bond. Each column represents a date on which one or more of the bonds has a cash flow. A 0 means the bond did not have a cash flow on that date. The dates associated with the columns are listed in AllDates returned as a datetime array.

[CFBondDate, AllDates, AllTF, IndByBond] = ...

cfport(CFlowAmounts, CFlowDates, TFactors)CFBondDate = 2×7

-1.8000 2.0000 2.0000 2.0000 0 102.0000 0

-0.6694 0 2.5000 0 2.5000 0 102.5000

AllDates = 7×1 datetime

03-Aug-1999

15-Aug-1999

15-Dec-1999

15-Apr-2000

15-Jun-2000

15-Aug-2000

15-Dec-2000

AllTF = 7×1

0

0.0663

0.7322

1.3989

1.7322

2.0663

2.7322

IndByBond = 2×5

1 2 3 4 6

1 3 5 7 NaN

Input Arguments

Cash flow amounts, specified as number of bonds

(NUMBONDS) by number of cash flows

(NUMCFS) matrix with entries listing cash flow

amounts corresponding to each date in CFlowDates.

Data Types: double

Cash flow dates, specified as an

NUMBONDS-by-NUMCFS matrix with

rows listing cash flow dates using a datetime array, string array, or date

character vectors for each bond and padded with NaNs. If

CFlowDates is a serial date number or a date

character vector, AllDates is returned as an array of

serial date numbers. If CFlowDates is a datetime array,

then AllDates is returned as a datetime array.

To support existing code, cfport also

accepts serial date numbers as inputs, but they are not recommended.

Data Types: char | string | datetime

(Optional) Time between settlement and the cash flow date, specified as an

NUMBONDS-by-NUMCFS matrix with

entries listing the time between settlement and the cash flow date measured

in semiannual coupon periods.

Data Types: double

Output Arguments

Cash flows indexed by bond and by date, returned as an

NUMBONDS by number of dates

(NUMDATES) matrix. Each row contains a bond's cash

flow values at the indices corresponding to entries in

AllDates. Other indices in the row contain

zeros.

List of all dates that have any cash flow from the bond portfolio,

returned as an NUMDATES-by-1 matrix.

The AllDates matrix is expressed in datetime format (if

CFlowDates is in datetime format).

Indices by bond, returned as an

NUMBONDS-by-NUMCFS matrix. The

ith row contains a list of indices into

AllDates where the ith bond

has cash flows. Since some bonds have more cash flows than others, the

matrix is padded with NaNs.

Version History

Introduced before R2006aAlthough cfport supports serial date numbers,

datetime values are recommended instead. The

datetime data type provides flexible date and time

formats, storage out to nanosecond precision, and properties to account for time

zones and daylight saving time.

To convert serial date numbers or text to datetime values, use the datetime function. For example:

t = datetime(738427.656845093,"ConvertFrom","datenum"); y = year(t)

y =

2021

There are no plans to remove support for serial date number inputs.

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Seleccione un país/idioma

Seleccione un país/idioma para obtener contenido traducido, si está disponible, y ver eventos y ofertas de productos y servicios locales. Según su ubicación geográfica, recomendamos que seleccione: .

También puede seleccionar uno de estos países/idiomas:

Cómo obtener el mejor rendimiento

Seleccione China (en idioma chino o inglés) para obtener el mejor rendimiento. Los sitios web de otros países no están optimizados para ser accedidos desde su ubicación geográfica.

América

- América Latina (Español)

- Canada (English)

- United States (English)

Europa

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)