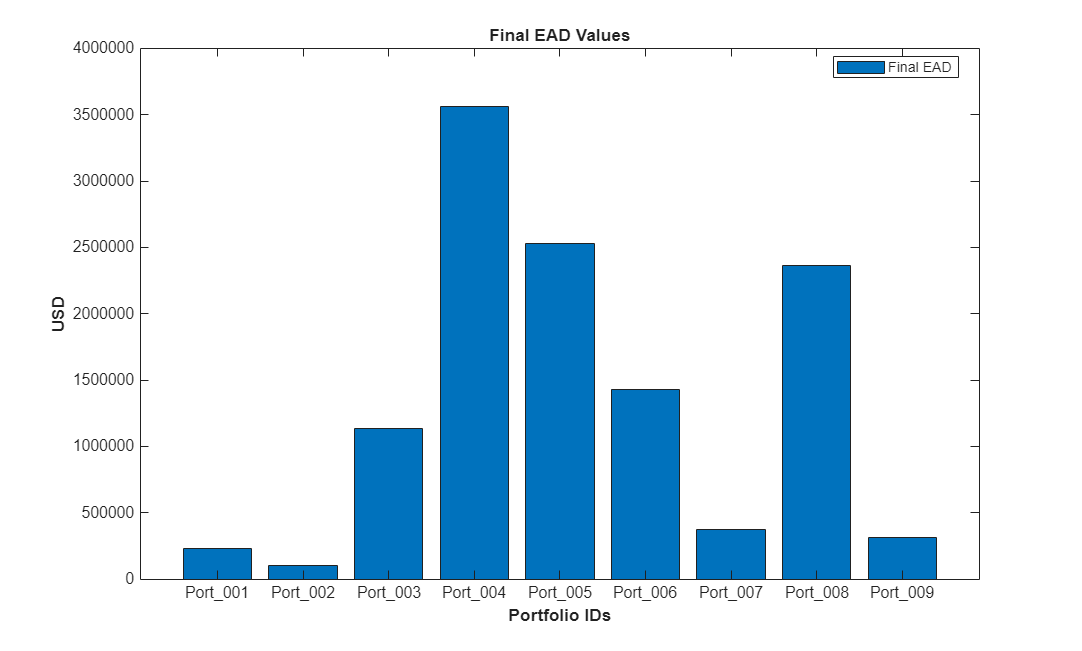

eadChart

Syntax

Description

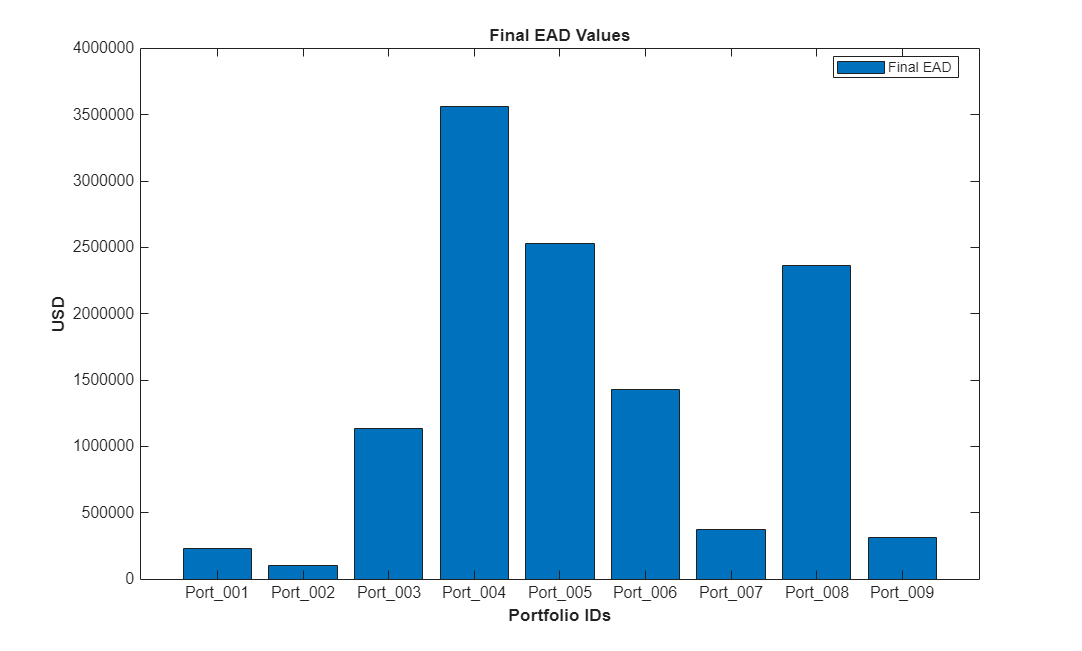

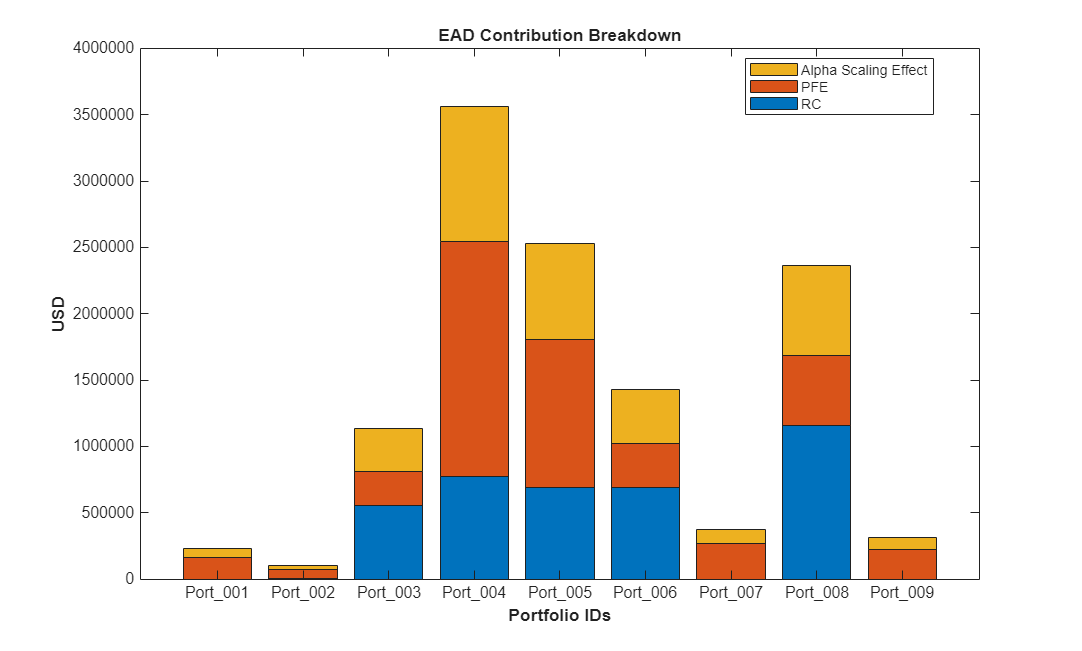

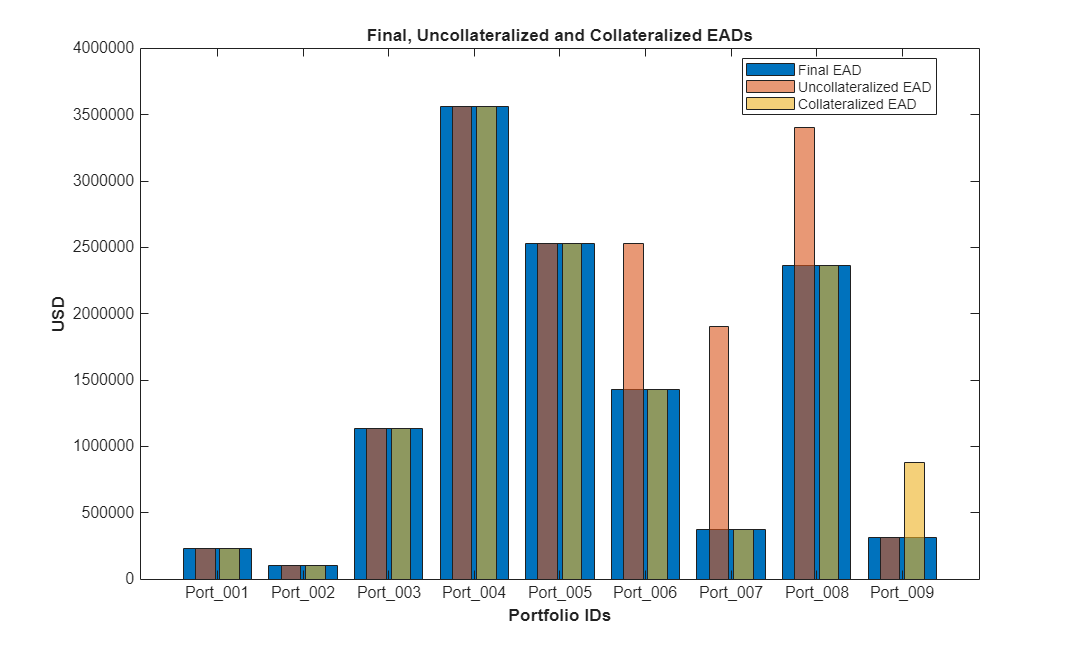

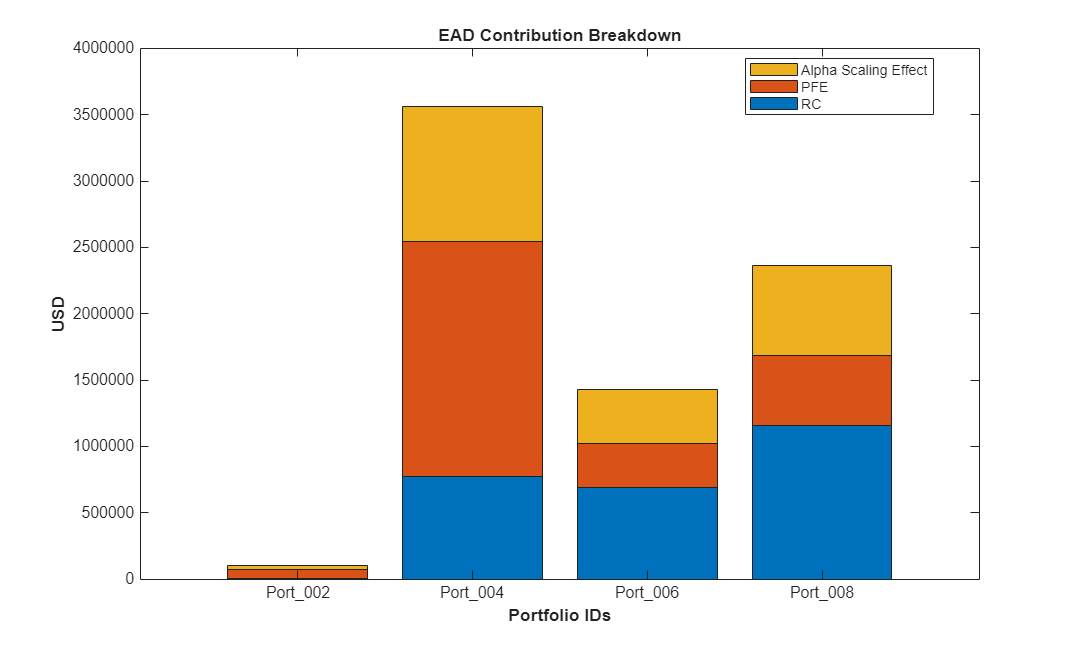

eadChart( creates a chart of

portfolio exposure-at-default (EAD) values. Each EAD value can be decomposed into

contributions from replacement cost (RC), potential future exposure (PFE) and alpha

scaling. The final EAD values are selected between the uncollateralized and collateralized

values to minimize EAD. For more information on EAD values, see Exposure at Default.saccrObj)

eadChart(

creates a chart of portfolio EAD values using optional name-value arguments.saccrObj,Name=Value)

Examples

Input Arguments

Name-Value Arguments

Output Arguments

References

[1] Bank for International Settlements. "CRE52 - Standardised Approach to Counterparty Credit Risk." June 2020. Available at https://www.bis.org/basel_framework/chapter/CRE/52.htm.

[2] Bank for International Settlements. "CRE22- Standardised Approach: Credit Risk Migration." November 2020. Available at https://www.bis.org/basel_framework/chapter/CRE/22.htm.

[3] Bank for International Settlements. "Basel Committee on Banking Supervision: The Standardised Approach for Measuring Counterparty Credit Risk Exposures." April 2014. Available at https://www.bis.org/publ/bcbs279.pdf.