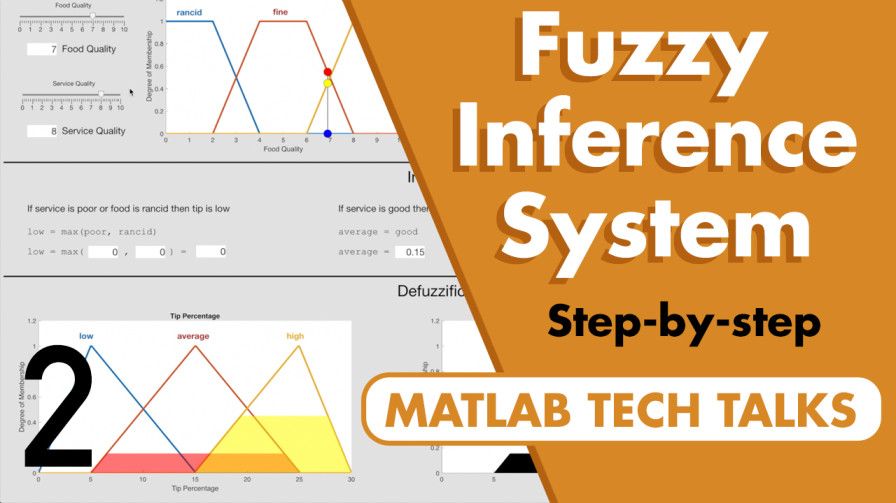

What Is Fuzzy Logic? | Fuzzy Logic, Part 1

From the series: Fuzzy Logic

Brian Douglas, MathWorks

This video introduces fuzzy logic and explains how you can use it to design a fuzzy inference system (FIS), which is a powerful way to use human experience to design complex systems. Designing a FIS does not require a model, so it works well for complex systems with underlying mechanisms that are not fully known. If you have some experience and intuition about the system, then you can develop and implement the rules.

Published: 17 Aug 2021